Shareholder Returns

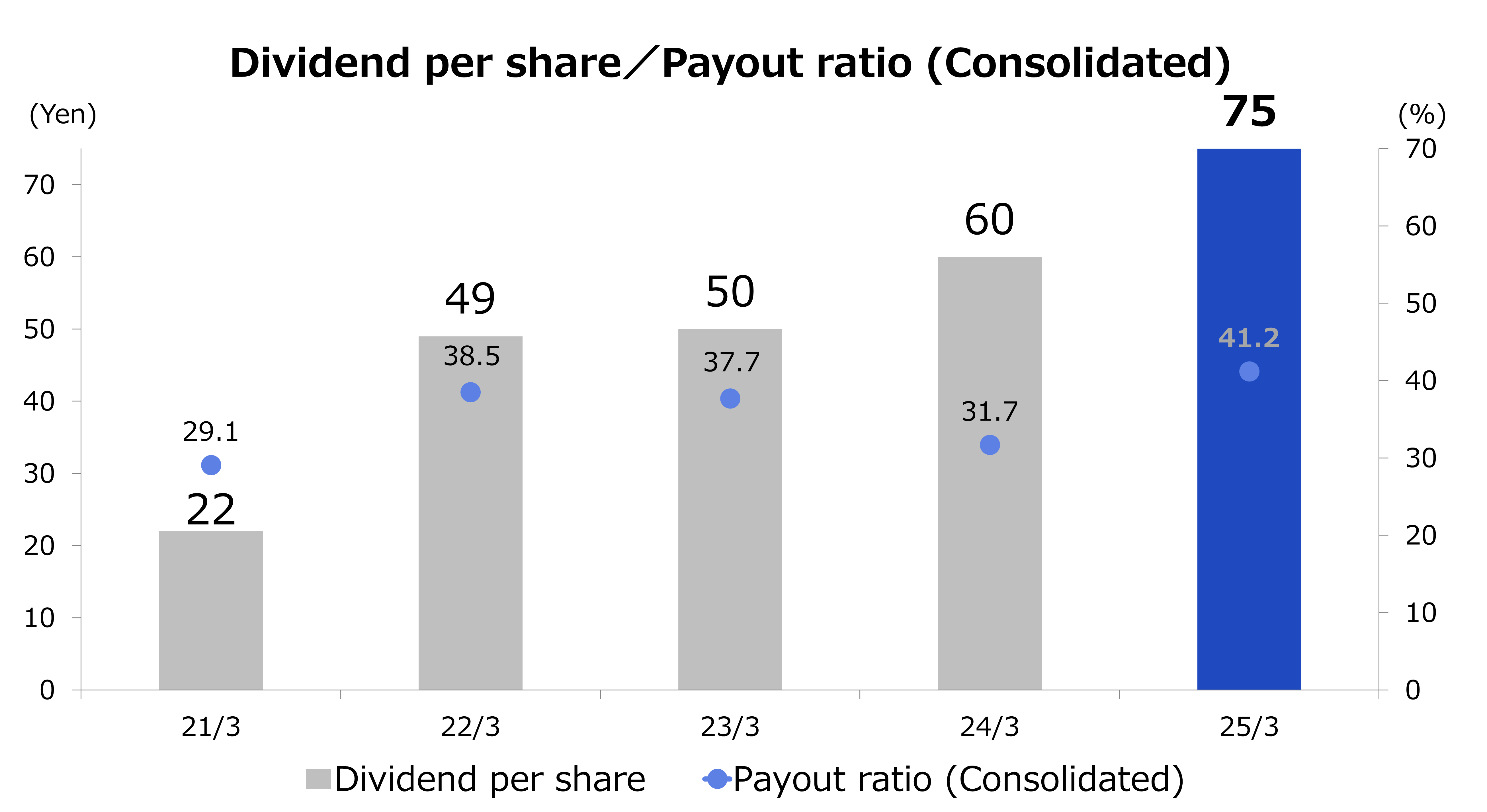

Dividends

Although the Company has had a basic policy of striving to maintain a stable level of shareholder returns and dividends by enhancing the return of profits to shareholders and ensuring constant profitability, the Company has decided that, from the dividends for the year ending March 2022 (interim dividend to be paid in 2021), while still maintaining stable dividends, it will link shareholder returns to business performance, taking into account internal reserves that give consideration to future business development and the characteristics of our business. With this decision, the dividend amount will be determined with the aim of a consolidated payout ratio of 30%. In excluding cases of a marked deterioration in business performance due to sudden changes in the management environment, there will be a lower limit of 20 yen per share per year (10 yen each per share for interim and end-of-year dividend). The decision-making body for the distribution of earnings surpluses will be the General Meeting of Shareholders for end-of-year dividends and the Board of Directors for interim dividends, with a policy of issuing dividends twice a year.

Regarding shareholder returns, the Company believes that it is appropriate to prioritize returns that correspond to business performance while maintaining stable dividends as described above, and it has abolished the special benefits given to shareholders of one unit (100 shares) or more with March 31, 2020 as the date of record.